Table of Contents

ToggleIntroduction

In today’s tech-savvy world, Bitcoin has made a big splash as an innovative digital currency that grabs the interest of investors, tech experts, and even governments. Starting in 2009, it kicked off a huge change in the cryptocurrency market by bringing in a system that’s open for everyone to see and doesn’t rely on any central authority. With the Bitcoin network making quick and safe transactions directly between people possible, it looks set to really change how we handle money going forward.

Key Highlights

- Bitcoin, the world’s first decentralized digital currency, has garnered immense attention and transformed the financial landscape since its inception in 2009.

- Operating on a revolutionary technology called blockchain, Bitcoin enables secure, transparent, and peer-to-peer transactions without the need for intermediaries like banks or governments.

- From its humble beginnings, Bitcoin has witnessed remarkable growth, reaching an all-time high price and captivating investors worldwide.

- Despite its volatility, Bitcoin continues evolving, with ongoing developments and increasing adoption by individuals, businesses, and even countries.

- This blog explores Bitcoin’s fascinating journey, delving into its history, functionality, benefits, risks, and future possibilities.

The Origins of Bitcoin

Back in 2008, when the world was going through a lot of financial trouble, someone or some people using the name Satoshi Nakamoto came up with an idea. They shared this idea in a document called “Bitcoin: A Peer-to-Peer Electronic Cash System.” This wasn’t just any ordinary plan it was about creating Bitcoin, a new type of money that didn’t rely on banks or anything like that. Because it showed up at a time when many were losing faith in traditional ways of handling money, Bitcoin quickly caught everyone’s attention and started to grow fast.

The Concept and Creation

Satoshi Nakamoto introduced an idea in their white paper about a way people could send money to each other directly, without needing anyone else in the middle. They suggested using a shared record keeping system that everyone can see, called the blockchain. This was a big deal because it solved some major problems that stopped digital money from working well before, especially the issue where someone might try to spend their money twice.

In January 2009, something exciting happened, the Bitcoin network started with what’s known as mining of the genesis blockchai the very first piece of this new kind of online ledger for Bitcoin. That moment is when Bitcoin really began as something you could use like real money. There was even a special note left inside this first block that mentioned news from that day which might give us clues about why Satoshi created Bitcoin.

Even though nobody knows who Satoshi Nakamoto really is they disappeared after making their project public what they made has kept growing and changing how we think about and use money all over the world.

Satoshi Nakamoto and the Genesis Block

Satoshi Nakamoto, a name wrapped in mystery, is known as the brain behind the Bitcoin protocol and the very first block of its kind, called the genesis block. Despite many efforts to figure out who they really are, Satoshi’s true identity remains unknown. Some think this genius was one person; others argue it might have been a team effort.

On January 3rd, 2009, with the mining of the genesis block came into being both Bitcoin’s blockchain and its currency form. This event stands as proof of what Satoshi envisioned: a world where systems could operate independently without central control. The special thing about this initial block is that there were no blocks before it signaled Bitcoin’s official start.

Even though Satoshi stepped back from their creation after some time had passed since then has only seen their invention grow stronger by inspiring people worldwide and changing how we view money and financial transactions forever.

SEE ALSO : Essential Guide to Ethereum: Price, News & Updates

How Bitcoin Works

Bitcoin runs on an innovative technology known as blockchain, which is the core of how it works. This blockchain acts like a public book that keeps track of every Bitcoin transaction ever made, doing so in a way that’s safe and clear for everyone to see. With this system spread out across computers all over the globe, it makes sure no one person or group can have all the power over Bitcoin. When someone makes a transaction, through something called mining, it gets checked and then added to this ledger. This process helps keep everything honest and unchangeable on the network.

Understanding Blockchain Technology

At the core of Bitcoin, there’s this cool tech called blockchain that has really shaken things up and gotten a lot of people excited in different fields. So, what’s the deal with blockchain and why is it such a big deal ?

Well, think of a blockchain as an online notebook that everyone can see but no one owns by themselves. It spreads across lots of computers all over the place. The thing about the Bitcoin blockchain is it keeps track of every single Bitcoin transaction ever made kind of like writing them down in stone so nobody can mess with them.

Because everything is spread out instead of being kept in one spot, we don’t need middlemen like banks or governments to make sure our transactions go through safely. We can just send stuff directly from person to person. On top of that, since everybody can see these transactions happening on the blockchain, it makes everything super transparent and builds trust because you know nobody’s cheating.

- With bitcoin at its center,

- By using blockchain technology,

- Without needing any intermediaries,

- Keeping records on a digital ledger,

Mining: The Heartbeat of Bitcoin

Bitcoin mining is super important because it keeps the whole Bitcoin network safe and working well. Miners use powerful computers to figure out really tough math problems, and the first one who gets it right can add a new bunch of transactions, called a block, to the blockchain.

This method is called Proof of Work. It makes sure that adding new blocks to the blockchain is done in a way that’s both secure and can be checked by others. For all their hard work, miners get some Bitcoins as a prize, which we call the block reward.

But there’s more to mining than just making new Bitcoins. It also helps check transactions are legit which keeps everything honest on the Bitcoin network and stops people from trying any funny business.

SEE ALSO : NFTs -From Digital Art to Making Money: How NFTs Are Changing the Game in the Online Art Scene ?

Key Milestones in Bitcoin’s History

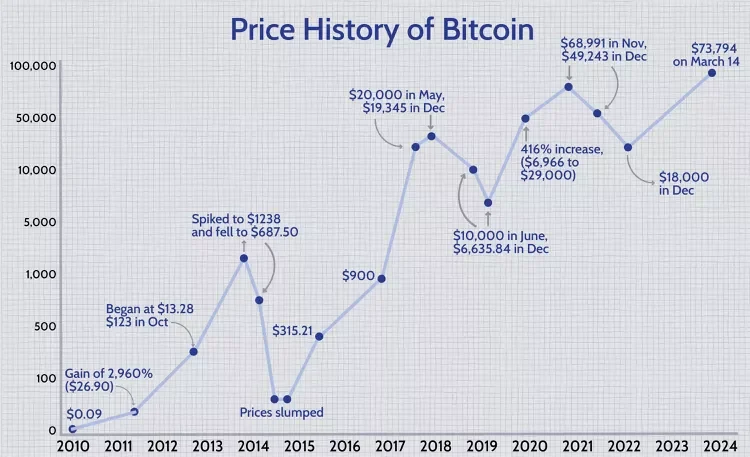

Over the last ten years, Bitcoin has had an amazing journey filled with important events that have helped shape its path. It started off small but quickly became a big deal worldwide, always managing to grab everyone’s attention.

Among these significant moments was when Laszlo Hanyecz, a programmer, made history by buying two pizzas with 10,000 Bitcoins. This wasn’t just about using Bitcoin to buy something; it showed how much Bitcoin’s value could increase over time.

From Pizza to Billion-Dollar Transactions

On May 22nd, we celebrate Bitcoin Pizza Day. It’s a special day that marks the first time someone used Bitcoin to buy something in the real world. Back in 2010, a guy named Laszlo Hanyecz spent 10,000 BTC on two pizzas. If you think about what those Bitcoins would be worth today, it’s mind-blowing – literally millions of dollars for just two pizzas! This story really shows how far Bitcoin has come from being this little tech project only a few people knew about to becoming this huge digital money thing that lots of folks and even big companies are into now.

As more and more people started using Bitcoin, its value went through the roof. We’re talking going up to billions and then trillions of dollars in market capitalization. That means a lot of people see it as valuable and want to own some or use it.

But with all these transactions happening every day, there was an issue that popped up: transaction fees got higher because there were so many transactions but not enough space for them all at once on the network. To fix this problem without making everything super slow or expensive forever they came up with new ideas like the Lightning Network which makes sending bitcoins cheaper and faster by handling transactions differently.

Regulatory Milestones and Challenges

With Bitcoin being decentralized, it works without the need for central banks or government oversight. This setup has been a real head-scratcher for regulators all over the globe. As more people started buying into Bitcoin and its value went up, governments and their central banks were left figuring out how to deal with this new kind of money.

A major turning point came when El Salvador stepped up in 2021, making Bitcoin legal tender. It was a groundbreaking move as no other country had ever officially welcomed Bitcoin like this before. This decision kicked off lots of discussions on what it means for a country to fully accept Bitcoin and the hurdles that might come with it.

Even with more eyes watching, many places around the world still don’t have strict rules about using Bitcoin. This grey area can be seen as both good and bad since it encourages fresh ideas but also brings up worries about keeping consumers safe and preventing unfair market practices.

SEE ALSO : Understanding Cryptocurrency: A Comprehensive Guide

Bitcoin’s Economic Impact

With the arrival of Bitcoin, there’s been a big shake-up in how we think about money, finance, and investing all over the world. Because it doesn’t rely on central banks to operate, people are really talking about what money will look like going forward and how governments fit into this new digital era.

On top of that, since there’s only so much Bitcoin available and it’s designed to decrease in value slowly unlike regular money which can lose value because too much is printed – investors see it as a good option for protecting their wealth when times get uncertain.

Bitcoin as a Currency

Bitcoin has had quite the ride as a form of money. People like it because it’s not controlled by any one place, you can use it all over the world, and usually, you don’t have to pay as much in fees compared to using regular money like dollars.

Even though more places are starting to accept Bitcoin for buying things, it’s still not as common as other ways we pay for stuff. The main reasons are that its value jumps around a lot and there’s still some confusion about how governments view or regulate it. This makes folks hesitant to use Bitcoin for everyday shopping.

On the bright side, there’s something called the Lightning Network being worked on. It aims at fixing some big issues with Bitcoin so that transactions can happen faster without costing too much in fees. This could really help make Bitcoin more popular for paying things everywhere.

Investment and Speculation

Bitcoin has really made a name for itself, grabbing the attention of people who want to dive into the cryptocurrency market. It’s known for its ups and downs in value, which makes it pretty exciting but also risky for folks looking to invest.

For some, Bitcoin is like digital gold. They’re drawn to it because they think it’s rare and can protect their money from losing value over time due to inflation. Then there are those who jump on the Bitcoin bandwagon hoping not to miss out on making a quick buck because everyone else seems to be doing it.

Throughout its existence, the price of bitcoin has been like a rollercoaster with big jumps up and steep drops down. This wild ride means anyone thinking about putting their money into Bitcoin should do their homework first so they know exactly what they’re getting into.

Technical Innovations and the Future of Bitcoin

As Bitcoin keeps growing, the tech around it is getting better too. People who make and build things are always trying to do more with it, especially making Bitcoin faster, safer, and easier to use. A big thing they’re working on is making sure Bitcoin can handle lots of transactions at once since that’s been a problem.

With stuff like the Lightning Network and Segregated Witness (SegWit), they’re finding ways to make everything run smoother on the blockchain. This means we could see more people using Bitcoin because it’s quicker and doesn’t cost as much for each transaction.

Scalability Solutions

As the Bitcoin network has gotten more popular, it’s run into a big problem: it can’t handle all the transactions fast enough. This is because there are only so many transactions that can fit in each block, and blocks come out at set times. Because of this, sending bitcoins has become slower and more expensive, which makes it hard for a lot of people to use.

To fix this issue, some smart folks have been working on different ways to make Bitcoin better at handling lots of transactions. One exciting solution they’ve come up with is called the Lightning Network. It works by moving some transactions off the main bitcoin blockchain, which means they can happen faster and cost less money.

With improvements like the Lightning Network being added on top of what we already have with Bitcoin’s system (including its fixed schedule for creating new bitcoins), there’s hope that Bitcoin will be able to support way more activity than before without getting bogged down. This could help make sure that as time goes on, even more people will be able to use bitcoin easily.

The Role of SegWit and Lightning Network

Back in 2017, Bitcoin got a big update called Segregated Witness, or SegWit for short. This was all about making the bitcoin blockchain better by letting it handle more transactions in each block. By doing this, things sped up and it cost less to send bitcoins around.

On another note, there’s something called the Lightning Network which tackles the problem of scaling but from a different angle. It works on top of the main bitcoin protocol as a second layer and lets people make payments between themselves without having to record every single one on the blockchain. Because of this setup, these transactions are super quick and much cheaper.

Putting both SegWit and the Lightning Network together has really pushed forward how well Bitcoin can handle lots of transactions at once. This makes using Bitcoin for everyday stuff way more practical than before. As more folks start using these technologies, Bitcoin is getting into shape to go head-to-head with traditional ways we pay for things.

Advantages and Disadvantages of using Bitcoin

| Advantages of Using Bitcoin | Disadvantages of Using Bitcoin |

|---|---|

| Decentralization and security of transactions | High volatility and risk |

| – No central authority; difficult to control or censor transactions | – Value fluctuates unpredictably, posing investment risk |

| – Secure due to cryptographic technology and blockchain ledger | – Not widely accepted by merchants |

| – Resistant to censorship and interference | – Lack of government regulation and backing |

| Reduced transaction fees compared to traditional banking | – Limited merchant acceptance |

| – Lower fees especially for international transactions | – Potential for fraud and scams |

| – Ongoing developments (e.g., Lightning Network) aim for lower costs | – Environmental impact of mining (energy consumption concerns) |

| Global accessibility and borderless transactions | – Requires internet access which may not be universal |

| – Easy movement of funds across borders with internet access | – Regulatory uncertainty in different countries |

| – Useful in politically unstable regions | – Complex technology may be intimidating for new users |

| Potential for anonymity and privacy protection | – Irreversibility of transactions can lead to accidental losses |

| – Transactions do not directly reveal personal information | – Potential for lost access to Bitcoins if private keys are lost |

| – Enhanced privacy through cryptographic methods | – Energy-intensive mining process contributes to environmental concerns |

| Possibilities for investment and growth in value | – Not backed by tangible assets, value determined by market demand |

| – Appreciation potential due to limited supply and growing interest | – Negative public perception due to associations with illegal activities |

Bitcoin’s Global Influence

Bitcoin is doing a lot more than just changing the tech and finance worlds. It’s also shaking things up on a global scale, making countries think differently about money in today’s digital world. When El Salvador made Bitcoin legal tender, it really got people talking all over the place. This move showed that some countries are starting to take cryptocurrencies seriously.

On top of this, because Bitcoin operates on its own without central control, it’s catching the eye of leaders and those who make policies around the globe. They’re trying to figure out how best to handle Bitcoin and other cryptocurrencies. There’s a big conversation happening about what good they can bring versus the problems they might cause as this new kind of technology spreads.

Adoption by Countries and Companies

In recent times, Bitcoin has really started to catch on as a real way to pay for things and invest money. With countries and businesses getting on board, its popularity is soaring. For instance, El Salvador made history by accepting Bitcoin as legal tender, showing other countries that this could be a smart move too. This is especially true in places where it’s hard to get traditional banking services.

On top of that, more and more companies are starting to keep Bitcoin among their assets. They see it as protection against inflation and a good investment strategy. Big names like Tesla and MicroStrategy have bought lots of Bitcoins, which shows they believe in its value for the long haul.

This shift towards mainstream acceptance proves how much faith people have in Bitcoin changing the finance game forever. While we’re still waiting to see just how big an impact it will make globally, there’s no denying that Bitcoin is shaking things up with balance sheets across industries recognizing its potential alongside nations like El Salvador leading the charge by making it legal tender.

The Environmental Debate

The debate around the environmental toll of bitcoin mining is heating up. People are worried about how it affects our planet, especially because it uses a lot of electricity, often from sources that aren’t good for the environment. This has led to calls for miners to use cleaner energy.

On the other side, folks who support bitcoin say they’re working on making things better. They’re looking at using clean energy like water, sun, and wind power more often. There’s even this thing called the Crypto Climate Accord that’s all about getting miners to switch to green energy faster.

As these discussions go on, there’s going to be more push for eco-friendly ways in mining crypto. How well Bitcoin does in future might just depend on its ability to become more environmentally friendly and show everyone it cares about our planet.

Security and Risks

Keeping Bitcoin safe is super important because, with Bitcoin being decentralized, it’s up to the users to look after their own security. To do this well, many people use hardware wallets. These gadgets keep your private keys offline and away from online dangers.

Even though the tech behind Bitcoin – things like blockchain and cryptography – makes it pretty secure on its own, how safe your Bitcoins are still depends a lot on what you do. It’s really important to stick to good security habits. This means making sure you have strong passwords, turning on two-factor authentication for an extra layer of protection, and always staying alert for sneaky phishing scams that try to trick you.

Protecting Your Bitcoin Assets

To keep your Bitcoin safe, it’s important to be ahead of the game when it comes to security. This is because if you lose your private key or can’t get into your digital wallet anymore, you might never see that money again. One top-notch way to protect your Bitcoin is by using hardware wallets.

With hardware wallets, we’re talking about physical gadgets made just for holding onto Bitcoin without connecting to the internet. They take care of keeping your private keys out of harm’s way from online dangers like hackers or harmful software. These devices make and hold onto your private keys without needing the internet, which pretty much blocks thieves from getting their hands on your Bitcoin even if they manage to mess with your computer.

On top of this, always bear in mind that the only thing letting you access your Bitcoins is private key . You should never let anyone else know what yours are and keep them somewhere very secure and offline if possible.

Understanding the Risks

Bitcoin is really safe to use, but using it does come with some risks, especially when we talk about security and getting tricked. Since you can’t take back a Bitcoin transaction once it’s done, losing your money because of hackers, scams or just making a mistake means you probably won’t get that money back.

With phishing scams being pretty common in the world of cryptocurrency, bad guys often try to fool people into giving away their secret keys or login details by sending fake emails or setting up fake websites. Before sharing any personal info online, make sure the website or email is legit. On top of this, watch out for investment opportunities that sound too amazing and ask you to send Bitcoin somewhere unknown. If something sounds way too good to be true, chances are it isn’t real at all.

Conclusion

Wrapping things up, Bitcoin has truly changed how we see and use money with its setup that doesn’t rely on central control, strong safety features, and the ability to make payments across borders. Starting off small, it’s now a big player in currency markets. Along its journey, Bitcoin hit many key points but also ran into some bumps. The good stuff includes cheaper costs for making transactions (transaction fees), sending money without worrying about country lines, and giving folks a new way to invest their cash. On the flip side, its price can jump around a lot which is risky; there aren’t enough rules in place yet; and it uses up a ton of energy which isn’t great for our planet. It’s super important to know what risks you’re taking on and how to keep your Bitcoin safe if you decide to dive in. As Bitcoin keeps impacting economies and tech all over the globe, it brings both exciting opportunities as well as warnings for where digital money is headed next.

Frequently Asked Questions About Bitcoin

Buying Bitcoin can be pretty safe if you go through a trusted crypto exchange. After getting it, make sure to keep your Bitcoin in a secure hardware wallet that’s not connected to the internet. By doing this, you’re taking good care of your private key and keeping your crypto investment safe from any online dangers.

Sure, you can turn Bitcoin into cash or even other types of money like US dollars. To do this, you’d use a crypto exchange where your Bitcoin is sold and the money from that sale goes right into your bank account. Another way is by using a Bitcoin ATM.

Investing in Bitcoin is seen as a gamble with the potential for big rewards. Its market value and how much its price has gone up over time are pretty remarkable. However, before putting money into it, investors need to think hard about how much risk they’re okay with taking on.

Back in 2009, when the genesis block first came into existence, Bitcoin didn’t really cost much. Since there wasn’t a market set up for it yet, its value was just a tiny bit of a cent. Not many people saw it as something that could be big in the world of digital currency.

Trying to guess what Bitcoin will be worth in 2030 is really just a big guess. Some experts think its price will go way up, while others aren’t so sure and prefer to wait and see. It’s important to keep in mind that how much Bitcoin ends up being worth depends on lots of different things, like how people feel about it and any new rules governments might come up with.

Your question seems a bit off. The worth of “1 Bitcoin” doesn’t stay the same at $1. To figure out “how much 1 Bitcoin is valued in US dollars,” you should look up its current price on a trusted bitcoin trading site or crypto market tracker. With changes happening all the time, the exchange rate never stays still.

2 thoughts on “Explore Bitcoin: History, Uses, and Future Potential”